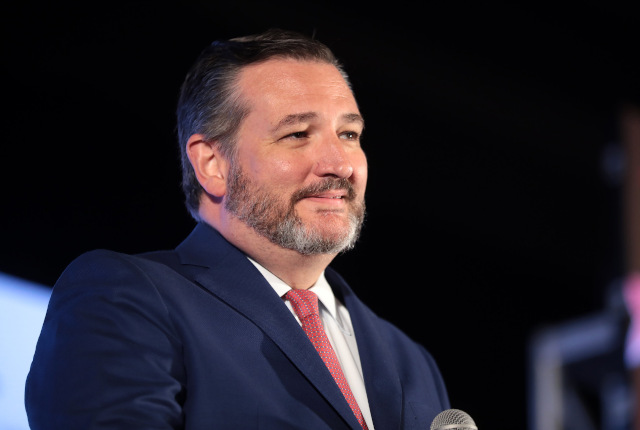

(DC Pundit) – In a move that is sure to have bartenders across America raising their glasses, Sen. Ted Cruz (R-Texas) has reintroduced a bill that would eliminate income tax on tip income. Yes, you read that correctly – a politician is now trying to put more money in the pockets of hardworking Americans. Who would’ve thought?

The proposed legislation, aptly named the “No Tax on Tips Act,” would allow workers to claim a 100% deduction on “cash tips,” including those received through cash, credit card charges, and checks.

Cruz isn’t going solo on this mission. He’s assembled a bipartisan team of senators, including Steve Daines (R-Mont.), Pete Ricketts (R-Neb.), Kevin Cramer (R-N.D.), Catherine Cortez Masto (D-Nev.), and Jacky Rosen (D-Nev.).

Now, before you start planning your early retirement based on tax-free tips, there are a few caveats. The deduction would be capped at $25,000 and workers making more than $150,000 wouldn’t qualify. Sorry, high-rolling sommeliers and celebrity bartenders – this party isn’t for you.

BREAKING: Ted Cruz just re-introduced the "No Tax on Tips Act" after Trump promised to eliminate taxes on tips. pic.twitter.com/xFKjvFGQG6

— Libs of TikTok (@libsoftiktok) January 16, 2025

Cruz, in his typical dramatic fashion, declared, “American workers in many industries rely on tipped wages to make ends meet.” Adding, “I’ve long believed the GOP should be the party of bartenders, of waiters and waitresses, and this bill is an important step to ensure we are addressing the economic needs of working Americans.”

Sen. Jacky Rosen chimed in, stating that this bill is just one piece of a broader reform she hopes to see for Nevada’s service and hospitality workers. “I’ll also keep fighting to raise the minimum wage and eliminate the subminimum wage for service employees, lower costs, and cut taxes for all hardworking Nevadans,” Rosen noted.

Interestingly, Cruz first introduced this legislation last June, following a Donald Trump rally where the idea was floated. The original bill, however, didn’t have bipartisan support and was left collecting dust like an unused tip jar.

Critics of the bill worry that the reduced taxes could lead to a higher deficit. Because heaven forbid we have a policy that benefits working-class Americans without someone crying foul about the budget.

It’s worth noting that workers in tipped industries like food and beverage and beauty services make up around 40% of the U.S. workforce. That’s a lot of people who could potentially benefit from this legislation – assuming it doesn’t get lost in the labyrinth of Washington bureaucracy.

Let’s raise a glass (or a tip jar) to the possibility of a little extra cash in the pockets of hardworking Americans. Every penny counts – especially when it’s tax-free.

Copyright 2025. DCPundit.com | Featured image credit: Gage Skidmore